2024-07-13 by Sue Hunt

A vacation property can be one of the most valuable things you can pass down to your loved ones, from both a sentimental and financial standpoint. However, mixing money and family can be tricky. Without a well-thought-out strategy for the ownership transition, hard feelings and disputes could arise, and the vacation home could be used in ways you did not intend. Beyond family dynamics and legacy objectives, transferring a vacation property to the next generation also has legal and tax implications that need to be addressed in an estate plan.

Vacation Homes Are a Store of Memories—and Wealth

It is that time of year when you and your loved ones may be preparing to spend time on the beach or in the mountains at the family vacation home. Around 5 percent of all housing units in the United States are second homes. There was a more than 16 percent surge in new vacation home purchases during the pandemic.[1] From humble cabins and beach cottages to luxurious mountain estates and lake houses, vacation homes are owned by an estimated 4 out of 10 Americans.[2]

Many second homes are dual-purpose, serving as a family gathering spot as well as a revenue source. Sites like Airbnb and VRBO have made it easier to rent out property. In 2023, the US short-term rental market, comprising more than 785,000 individual hosts, 2.5 million available listings, and 207 million nights stayed, generated approximately $64 billion in revenue.[3]

Vacation Home Estate Planning Considerations

As you clean up your vacation home and prepare to welcome your children, grandchildren, and other family members for another season of memory-making moments, estate planning may be a distant thought—if it is even on your mind at all.

But ensuring that the home remains a place for the family to gather for generations to come requires addressing it in your estate plan now, while you still own and control it. Here are some points to consider as you balance finances, feelings, and fairness in your vacation home estate plan:

These big picture estate planning issues for a vacation home can inform specific strategies such as the following about how to pass the property down:

Each of these strategies has a different set of pros and cons that you should further discuss with an estate planning lawyer.

Talk to a Lawyer About How Best to Keep a Vacation Home in the Family

Family can be complicated. Adding a treasured family vacation home to the mix only adds to the complications.

We recommend talking to your loved ones about the vacation property. Once you get answers to questions like who wants the vacation home, how much they might use it, and if they can take on ownership responsibilities, reach out to us to create a strategy that aligns with your personal circumstances and objectives.

[1] Theresa Landicho, 17 Second Home Statistics Every Investor Should Know in 2024, Fit Small Bus. (Feb. 13, 2024), https://fitsmallbusiness.com/second-home-statistics.

[2] Andrew Lisa, 40% of People Have Vacation Homes: Where You Can Find One for Your Budget, GoBankingRates (June 16, 2023), https://www.gobankingrates.com/investing/real-estate/where-to-find-vacation-home-in-your-budget.

[3] 2023 Short-Term Rental Statistics You Need to Know, AirDNA (Jan. 28, 2024), https://www.airdna.co/blog/2023-short-term-rental-statistics-key-numbers-to-know.

2025-01-13 by Sue Hunt

Although we may not always recognize it, financial decisions and tasks are a part of our everyday lives. They range from daily spending habits to more complex retirement planning.

You may take for granted that you are able to manage your finances. However, what if you become incapacitated (meaning that you lack the ability to handle your own affairs due to illness, injury, cognitive decline, or some other cause)? Someone else will have to manage your finances for you if you cannot.

If you have an updated estate plan that names a substitute decision-maker to act in your stead, you have control over who that someone is. Otherwise, the court will appoint a financial decision-maker, and it may not be who you would want—or who has your best interests in mind.

Guardianship or Conservatorship versus an Estate Plan

Two-thirds of US adults do not have an estate plan,[1] which effectively means that they lack an incapacity plan (a plan for how their affairs will be managed if they cannot do it for themselves).

You may have created a will and completed other estate planning tasks, such as purchasing life insurance and making beneficiary designations. However, you still need a documented, legally enforceable process and plan for determining who will manage your affairs if you become incapacitated.

To proactively grant the necessary powers to a financial decision-maker, consider a revocable living trust and a financial power of attorney.

One of the main purposes and benefits of a revocable living trust is to avoid the court-supervised probate process, but it can also be used to help avoid a different form of court intervention: the appointment of a legal guardian or conservator (the term may vary by state), which is the person appointed by the court to make financial and other decisions for you.

A financial power of attorney is highly flexible. It can include a statement describing how incapacity will be determined and who determines it; it can come into effect only when the principal's incapacitation is confirmed (in some states); it can specify the powers granted to the agent; and it can be limited or long-lasting in duration. Like a revocable living trust, a financial power of attorney helps eliminate the need for court-appointed guardianship or conservatorship.

Factors When Choosing a Financial Decision-Maker

When choosing a financial decision-maker, you should consider factors such as trustworthiness, financial knowledge, and the ability to handle responsibilities under pressure. The person selected should have a strong understanding of your values and priorities, be organized, and communicate effectively with other key parties, such as family members or advisors. Additionally, they should be available and willing to serve in this role, as it may require significant time and effort, particularly during complex situations.

If nobody in your immediate circle of friends and family seems like a good candidate, a professional, such as an attorney or financial advisor, can be chosen. However, many professionals are hesitant about serving in the role of an agent under a durable power of attorney, so you may want to consider other professionals, such as professional caregivers or fiduciaries. A professional trustee or agent is different from a professional guardian or conservator because it is a person of your choosing rather than the court's.

The bottom line is that estate planning lets you manage incapacity in advance, in the manner that is best for you, your finances, and your family. You are free to name whomever you want to serve as a successor trustee or an agent under your financial power of attorney and to provide whatever instructions you want for them in your estate plan.

You may never need to rely on an incapacity plan. However, having the right people and provisions in place gives you added protection and peace of mind just in case something happens and you lose financial capacity. For guidance on this front, call us today at 336-373-9877 to set up an appointment.

[1] Rachel Lustbader, 2024 Wills and Estate Planning Study, Caring.com (July 30, 2024), https://www.caring.com/caregivers/estate-planning/wills-survey.

2024-04-08 by Sue Hunt

As a parent, you are responsible for the care of your minor child. In most circumstances, this means getting them up for school, making sure they are fed, and providing for other basic needs. However, what would happen if you and your child's other parent were unable to care for them?

It is important to note that if something were to happen to you, your child's other parent is most likely going to have full authority and custody of your child, unless there is some other reason why they would not have this authority. So in most cases, estate planning is going to help develop a plan for protecting your child in the event that neither parent is able to care for them.

What If You Die?

When it comes to planning for the unexpected, many parents are familiar with the concept of naming a guardian to take care of their minor children in the event both parents die. This is an important step toward ensuring that your child's future is secure.

Without an Estate Plan

If you and your child's other parent die without officially nominating a guardian to care for your child, a judge will have to make a guardianship decision. The judge will refer to state law, which will provide a list of people in order of priority who can be named as the child's guardian—usually family members. The judge will then have a short period of time to gather information and determine who will be entrusted to raise your child. Due to the time constraints and limited information, it is impossible for the judge to understand all of the nuances of your family circumstances. However, the judge will have to choose someone based on their best judgment. In the end, the judge may end up choosing someone you would never have wanted to raise your child to act as your child's guardian until they are 18 years old.

With an Estate Plan

By proactively planning, you can take back control and nominate the person you want to raise your child in the event you and the child's other parent are unable to care for them. Although you are only able to make a nomination, your choice can hold a great deal of weight when the judge has to decide on an appropriate guardian. The most common place for parents to make this nomination is in their last will and testament. This document becomes effective at your death and also explains your wishes about what will happen to your accounts and property. Depending on your state law, there may be another way to nominate a guardian. Some states recognize a separate document in which you can nominate a guardian, and that document is then referenced in your will. Some people prefer this approach because it is easier to change the separate document as opposed to changing your will if you want to choose a different guardian or backup guardians.

What If You Are Alive but Cannot Manage Your Own Affairs?

Although most of the emphasis is on naming a guardian for when both parents are dead, there may be instances in which you need someone to have the authority to make decisions for your child while you are alive but unable to make them yourself.

Without an Estate Plan

Not having an incapacity plan in place that includes guardianship nominations means that a judge will have to make this judgment call on their own with no input from you (similar to the determination of a guardian if you die without a plan in place).

With an Estate Plan

A comprehensive estate plan can also include a nomination of a guardian in the event you and the child's other parent are incapacitated (unable to manage your own affairs). Although you are technically alive, if you cannot manage your own affairs, there is no way that you will be able to care for your minor child. This is another reason why having a separate document for nominating a guardian (as described above) may be preferable to nominating guardians directly in a last will and testament. Because a last will and testament is only effective at your death, a nomination for a guardian in your will may not be effective when you are still living. However, a nomination in a separate document that anticipates the possibility that you may be alive and unable to care for your child can provide great assistance to the judge when evaluating a guardian. Depending on the nature of your incapacity, this guardian may only be needed temporarily, with you assuming full responsibility for your child upon regaining the ability to make decisions for yourself.

What If You Are Just Out of Town?

Sometimes, you travel without your child and will have to leave them in the care of someone temporarily. While you of course hope that nothing will go wrong while you are away, it is better to be safe than sorry.

Without an Estate Plan

Without the proper documentation, there may be delays in caring for your child if your child were to get hurt or need permission for a school event while you are out of town. The hospital or school may try to reach you by phone in order to get your permission to treat them or allow them to attend a school event. Depending on the nature of your trip, getting a hold of you may not be easy (e.g., if you are on a cruise ship with little access to phone or email). Ultimately, your child will likely be treated medically, but the chosen caregiver may encounter additional roadblocks trying to obtain medical services for your child, and they may not be able to make critical medical decisions when needed.

With an Estate Plan

Most states recognize a document that allows you to delegate your authority to make decisions on behalf of your child to another person during your lifetime. You still maintain the ability to make decisions for your child, but you empower another person to have this authority in the event you are out of town or cannot get to the hospital immediately. This document allows your chosen caregiver to make most decisions on behalf of your child, except for consenting to the adoption or marriage of your child. The name of this document will vary depending on your state and is usually effective for six months to a year, subject to state law. Because this document is only effective for a certain period of time, it is important that you touch base with us to have new documents prepared so that your child is always protected.

We Are Here to Protect You and Your Children

Being a parent is a full-time job. We want to make sure that regardless of what life throws at you, you and your child are cared for. Give us a call to learn more about how we can ensure that the right people are making decisions for your child when you cannot.

2022-07-25 by Sasha Hartzell

Despite the fact that it happens to every single one of us and is as every bit as natural as birth, very few among us are properly prepared for death—whether our own death or the death of a loved one.

Yet the pandemic might be changing this.

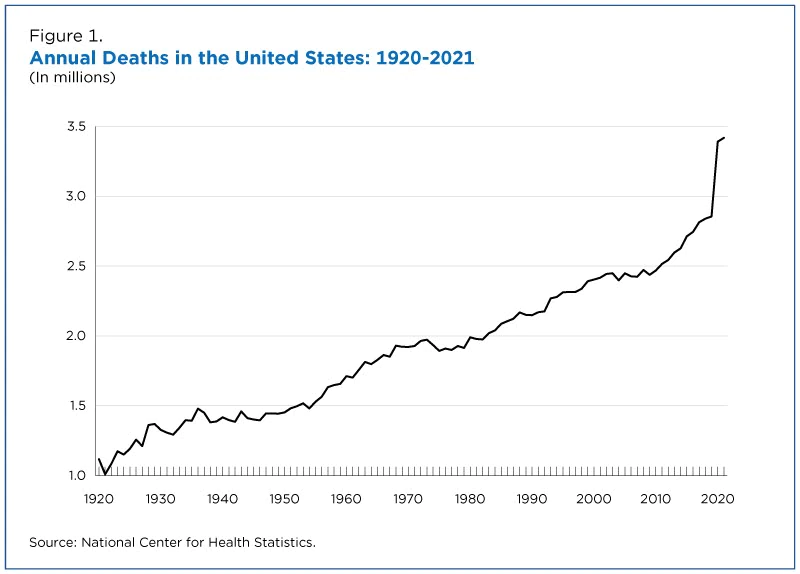

According to Census figures, the pandemic caused the U.S. death rate to spike by nearly 20% between 2019 and 2020, the largest increase in American mortality in 100 years. More than two years and 1 million deaths later, it's more clear than ever that death is not only ever-present, but a central and inevitable part of all our lives.

Graph from the United States Census BureauSome in the end-of-life industry believe that the pandemic's massive loss of life has created an opportunity to transform the way we interact with death, grief, and all of the other issues that arise with the loss of a loved one. Seizing the moment, one startup recently launched Empathy, an AI-based platform designed to help families navigate the death of a loved one. "We're on a mission to change the way the world deals with loss," reads Empathy's 'About Us' page. The company's CEA and Co-Founder, Ron Gura echoes this sentiment:

"For far too many, COVID-19 has been a terrible reminder that death and loss are all around us. But it also represents an opportunity to shift public perception, to bring a topic that has been for far too long shrouded in darkness into the light of day, where we can fully examine it and figure out how best to help those who have to shoulder its burdens."

- Ron Gura, Co-Founder of Empathy

The death of a loved one generates a cascade of emotional, logistical, and financial challenges for those left behind. To further shed light on just how vastly unprepared most of us are when dealing with death, in March 2022 Empathy released its first-ever Cost of Dying Report. In partnership with Goldman Sachs, Empathy's report surveyed more than 2,000 Americans—each of whom had lost a loved one in the last five years—to get a clearer picture of dying's true cost to families.

The report looked not only at the financial burden dying brings, but also at the cost in time, stress, harmed productivity, and strained interpersonal bonds. Complete with insights from advisors, partners, and experts in bereavement, the Cost of Dying Report "bust open the taboo that has for too long kept it out of the public consciousness," said Gula.

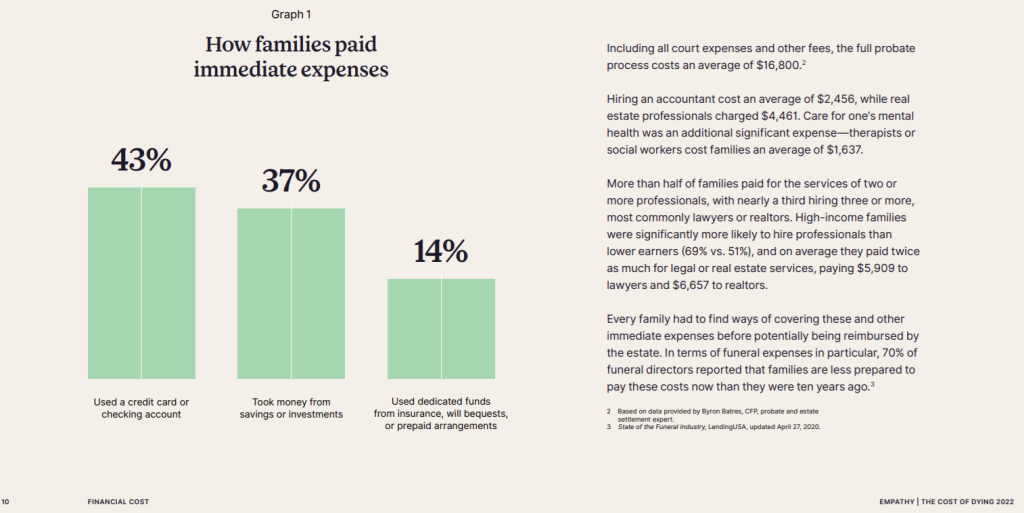

Empathy found that the average total bill of death is $12,702. The average cost of a funeral was $7,267—according to the National Funeral Directors Association, that cost has risen 7.6% in the last 5 years. On top of the funeral, families paid an average of $5,846 to hire additional professionals such as lawyers, financial advisors, therapists, and realtors.

Excerpt from The Cost of Dying Report by Empathy

Excerpt from The Cost of Dying Report by Empathy

The average cost of lawyers fee's following the death of a loved one was $3,910. This amount, however, is nearly doubled for estates that required the court process of probate, as was the case for one-third of families surveyed; the average total cost to complete probate for the families surveyed was $16,800.

Beyond the purely financial, The Cost of Dying Report found that families spent 13-20 months completing end-of-life tasks for their deceased loved ones. Study participants clocked an average of 420 hours of work to handle an estate with around five phone calls a week (26 hours per month on the phone!) The majority of families also said it took longer to much longer than expected to wrap up all of the necessary tasks.

In the words of contributing attorney Avi Z. Kestenbaum, "every estate is settled eventually. Even the most complex one. But it is very often a long road to get there—and if you think you know how long, you probably don't."

So how do families cover all of these expenses? Unfortunately, the report found that only one in seven families had the costs associated with their loved ones' death prepaid, or were able to use inherited funds. Additionally, more than 50% of families had to deal with estates that included debt. To foot the bill for these expenses, 36.1% of respondents used their own savings or investments, while 42.4% used their checking accounts or credit cards.

For most families, the financial costs associated with loss were exacerbated by a lack of information about exactly how much money they should expect to spend, according to physician Shoshana Ungerleider, MD, in the report's section on death's financial cost. Compounding that stress, Ungerleider says, was the families' fear of making a mistake that will make their financial burden even worse.

"A majority of families find themselves unprepared for and under-informed about the real financial costs of death, with few available resources for finding out," writes Ungerleider. "They can spend months or years terrified that a wrong move will wipe out their inheritance or even their own savings."

As an example of what such a mistake might look like, Ungerleider notes that a lack of proper estate planning can lead to the deceased's home being seized after death for Medicaid Recovery, even if the family member who was their primary caregiver is still living in the home.

Fortunately, there are ways you can dramatically reduce the financial, logistical, and emotional burden for your loved ones upon your death. There are strategies to help your family to avoid the time, expense, and emotional burden associated with probate, such as by placing assets in a properly created and maintained revocable living trust. We also offer planning strategies that can help you and/or your senior parents qualify for Medicaid and other benefits, without putting the family home or other assets at risk.

Our end-of-life planning also includes asset protection, avoiding family conflict, funding long-term care, and estate tax mitigation, just to name a few. Sit down with us for a Family Wealth Planning Session to find the most effective and affordable planning solutions for you and your family.

The more you prepare for your own eventual death and learn about the process, the more support you can offer friends and family members who have recently lost a loved one. As Kestenbaum notes, "as a society, then, we can be much more aware not only of the stress that our bereaved friends, neighbors, coworkers, or employees are under, but also understand that the pressure will persist for a very long time. So even one year later, try to ask: How are you? Is there anything I can do to help? That will be very meaningful."

by Julia Walker

Backup Plans Are Loving Too: Why You Need Contingent Agents and Guardians

Progressive Insurance recently rolled out a series of commercials featuring “backup” quarterbacks stepping in to handle everyday challenges, such as ordering food, giving advice, and even parking a trailer. After the “backup” salvages the situation, each commercial ends with the same line: “If only there were backups in real life.”

The ads are designed to emphasize how a backup can provide peace of mind when the unexpected occurs, as it often does, in both football and life. Progressive frames the point simply: “It’s always a good idea to have a backup plan.”

The humor hinges on the premise’s absurdity. In most areas of life, a person cannot summon a backup to act on their behalf during a deeply personal moment and expect that substitute to seamlessly complete the task.

Estate planning represents a notable exception. Real-life backups are contingent decision-makers designated in advance to step in if a primary decision-maker cannot serve. These contingents function much like backup quarterbacks: prepared to act quickly, often under pressure, and sometimes when the stakes are high.

An estate plan that names only primary decision-makers may appear complete on paper. Without contingents, however, the plan lacks the depth needed to remain effective when circumstances change, much like a football team without a backup quarterback.

Backups Prevent Chaos

When a team has no backup quarterback, it risks losing its entire passing game the moment the starter goes down. In desperation, coaches may be forced to put a nonquarterback under center to keep the game moving, with predictably disastrous results.

After a high-profile game exposed this exact problem, the National Football League changed its rules,[1] adopting an “emergency quarterback” policy to ensure that, even in extreme circumstances, a team would not be left without an on-field quarterback.

The logic is structural rather than sentimental: the quarterback is a control point for the entire strategy, and the system quickly falls apart when no prepared backup exists to take over.

The same dynamic exists in estate planning. When a plan relies on a single decision-maker with no designated contingency, it creates a fragile structure—one illness, conflict, relocation, or instance of unavailability away from confusion, delay, or court involvement.

Contingents provide stabilization and strategic depth. They allow your estate plan to keep functioning even when life goes off script.

Fielding the Right Team in an Estate Plan

Backups are not expected to completely fill the starter’s shoes. If they could, they would be starting. However, they are expected to be part of the game plan so that, if they are needed, the drop-off is manageable and the system can continue to operate.

That is an excellent way to think about contingents in an estate plan. Their role is not perfection but continuity.

When backup decision-makers are not built in, all bets are off. Decisions stall. Authority becomes unclear. Courts or third parties may be forced to step in. And unlike football, where the fallout affects both players and fans, the real-world consequences land on family members, often during moments of stress, grief, or medical crisis.

Just as damaging as having no backup is having the wrong one. Naming someone who is unavailable, unprepared, or no longer appropriate can be the equivalent of signing a player off the street and hoping for the best. The position may be filled, but the drop-off is glaring, and the system will not function as intended.

Common Contingent Oversights and the Problems They Cause

Contingents, like backup quarterbacks, are best viewed as necessary additions to your decision-making team. Whether on the field or in real life, things rarely go exactly as planned. Not having the right backups in place can cause an otherwise well-drafted estate plan to quickly break down, sometimes at the worst possible moment.

Financial Power of Attorney

● Only one agent has been named, with no contingent agent.

● A contingent agent was named years ago and may no longer be an appropriate choice.

● Coagents are named without clear instructions on authority (for example, whether they must act jointly or may act independently, and how disagreements are to be resolved).

Result: Financial decisions stall, accounts freeze, and families may be forced to go to court.

Healthcare Agent

● Only one health care agent has been named, with no alternate.

● The named agent may be unavailable (out of state, difficult to reach, or unable to respond quickly during a medical event).

● The agent’s current views may no longer align with the client’s wishes (or the client’s wishes have evolved and have not been clearly communicated).

Result: Treatment decisions may be delayed, authority can become unclear, and family conflict often escalates during medical crises.

Executor or Personal Representative

● No alternate executor has been named.

● The named executor is unwilling or unable to serve.

● The named executor lacks capacity or lives far away, limiting availability for time-sensitive tasks.

Result: Probate is delayed, costs increase, and court involvement becomes more likely at a sensitive time.

Guardians for Minor Children

● A guardian has been named for one child but not for others.

● No backup guardian has been named.

● The named guardian’s circumstances have materially changed (health, location, family responsibilities, or financial stability).

Result: Courts must decide custody and identify backup choices without knowing the parents’ wishes.

Across all these roles, the pattern is the same. Change was unanticipated, and the plan failed as a result. Depth was never built into the system. Or if it was, it was the wrong kind of depth. The listed backup was not read into the game plan or in “playing shape.” They had not had sufficient practice to be game-ready.

Backups Are a Sign of Readiness

Nobody would accuse a team with a solid backup quarterback of being pessimistic or overly worrisome. Backups are standard procedure because the position carries high stakes, and the consequences of being unprepared are immediate.

Estate plans work the same way. Naming backups (successor trustees, alternate personal representatives, backup agents under powers of attorney, and contingent guardians) is not “expecting the worst.” It is smart redundancy: an added layer of protection that helps your plan hold up when life does not cooperate. And, just as with a team’s lineup order, those choices should be revisited and updated during regular plan reviews.

Teams do not hesitate to replace a backup when the fit is wrong for the system or the locker room, and you should not hesitate either. Sometimes the person you picked years ago has moved, become unavailable, changed in capacity, or is simply not the best match for what your family needs today.

In real life, just as in football, you sometimes need someone ready to step in when life does not go according to plan.

However you look at it, your backups are every bit as important as the starters in your estate plan and require a specific skill set—and preparation—to succeed when they are called.

Do you need to name backups or help choosing the right contingents? We are here to assist you in doing just that!

[1] NFL emergency third-quarterback rule: Questions and answers, NFL (Sept. 4, 2023), https://www.nfl.com/news/nfl-emergency-third-quarterback-rule-questions-and-answers.